Calculate instantly! Your online math assistant, you can use this calculator to compute compound interest, includes savings options, goals, graphs, and more.

Compound Interest Calculator

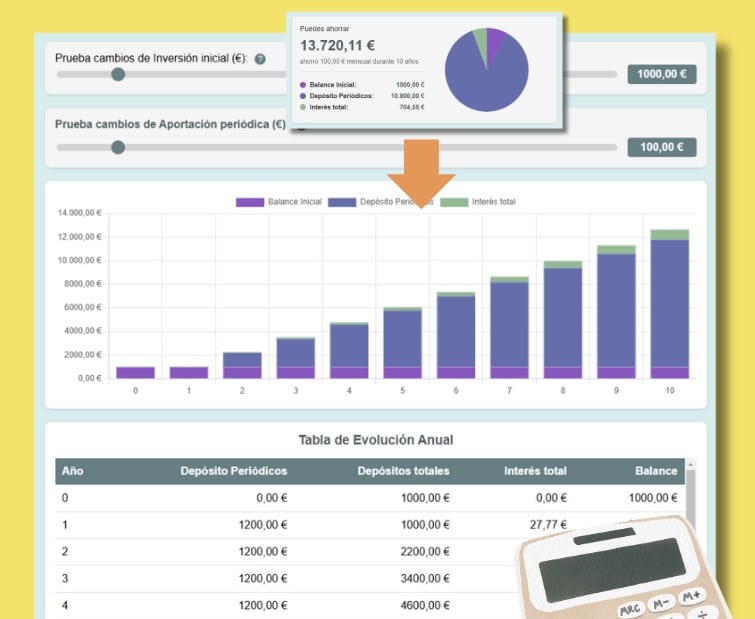

Annual Evolution Table

| Year | Periodic Deposits | Total Deposits | Total Interest | Balance |

|---|

Do you want to see other calculation tools?

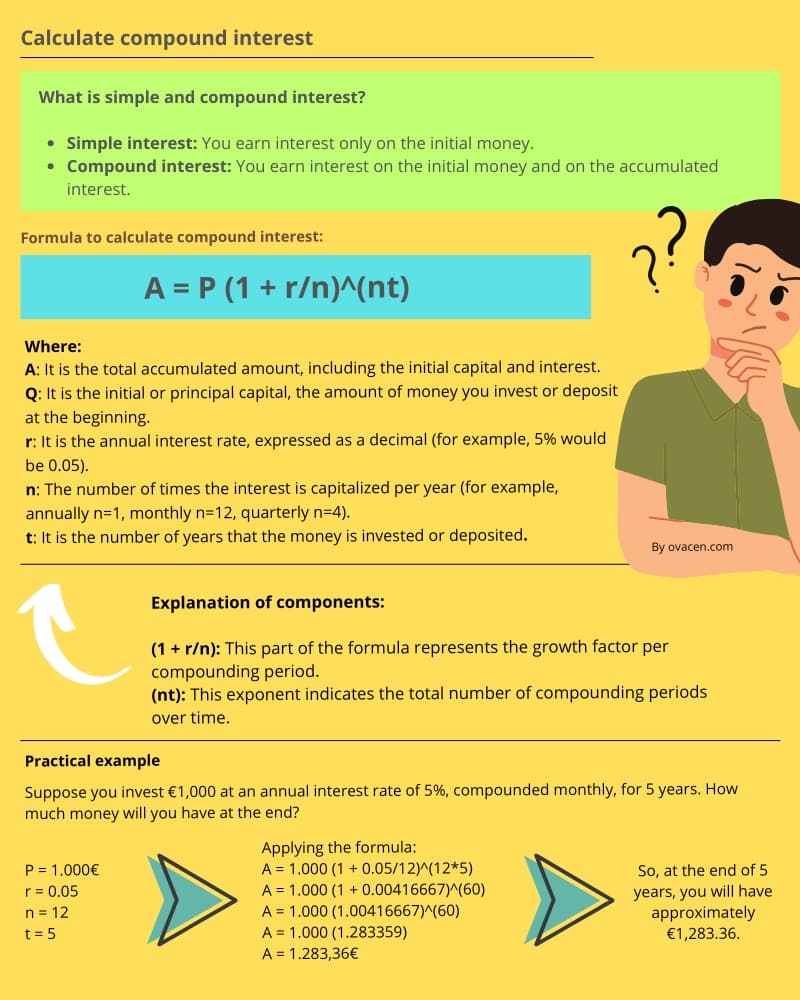

The compound interest estimator is a way of calculating interest in the financial field where, in addition to earning interest on the initial money you have or invest, you also earn interest on the interest that accumulates over time.

Mathematically, the formula to calculate compound interest is A = P × (1 + r/n)^(n×t), where each element is:

- A = Total accumulated amount (principal + interest)

- P = Principal capital

- r = Annual interest rate (expressed as a decimal)

- n = Number of times interest is compounded per year

- t = Time (in years)

- ^ = Raised to the power

For example, if you put $100 in an account that gives you 10% annual interest:

- The first year you earn $10, and now you have $110.

- The second year, the 10% is calculated on the $110, not just the original $100, so you earn $11 more, and end up with $121.

How much will you earn? Calculate compound interest and discover the power of growth. Plan your financial future now!

The compound interest makes your money grow more over time because the interest “accumulates” and generates more interest. It’s a great tool for saving or investing!

How does the compound interest calculator work?

The calculate compound interest allows you to calculate different aspects of your investment or savings according to your needs and choice. A simple explanation of each option:

- How much can I save? (montoFinal):

- Calculates the final amount accumulated by investing an initial amount, making periodic contributions, and obtaining a certain interest rate over a term.

- How long will it take to reach my savings goal? (tiempo):

- Determines the time it will take to reach a desired savings goal, starting from an initial capital, with regular contributions and an established interest rate.

- How much do I need to save each period to reach my goal? (aportacion):

- Calculates the amount you need to contribute each period (monthly, quarterly, annually, etc.) to achieve your savings goal in the established time.

- What interest rate do I need to reach my goal? (interes):

- Indicates the annual return rate you would need to obtain in your investment to reach your savings goal, considering your initial capital and periodic contributions.

- Retirement plan: How much to save to get a monthly income? (planRetiro):

- Estimates how much you should save periodically to have a capital that allows you to receive a monthly income during your retirement.

- Scheduled withdrawal: How much can I withdraw monthly? (retiroProgramado):

- Calculates the amount you could withdraw monthly from an initial capital, considering an interest rate and a period during which you plan to withdraw that money.

Depending on the choice of interest calculation and the data entered by the user, an analysis panel will appear with both summary metrics and result graphs.

Understanding how accrued interest becomes capitalized and fuels growth interest is essential for anyone looking to maximize their long-term savings.

How to calculate compound interest?

First, remember that the formula to calculate compound interest is A = P × (1 + r/n)^(n×t).

If you had to do the compound interest calculations, the process would be as follows step by step:

- Take these data:

- Initial money (what you invest, for example, $1000).

- Annual interest rate (like 5%, which you convert to 0.05).

- How many times the interest is added per year (for example, 1 if annual, 12 if monthly).

- Time in years (like 5 years).

- Use the compound interest formula:

- Final amount = Initial money × (1 + rate ÷ times per year)^(times per year × years).

- In symbols: A = P × (1 + r/n)^(n×t).

- Example of compound interest calculation:

- You invest $1000 at 5% annual (0.05), compounded 1 time per year, for 5 years.

- A = 1000 × (1 + 0.05/1)^(1×5).

- A = 1000 × (1.05)^5.

- A = 1000 × 1.27628 = $1276.28.

- Result of calculations:

- You end up with $1276.28. The interest you earned is $1276.28 – $1000 = $276.28.

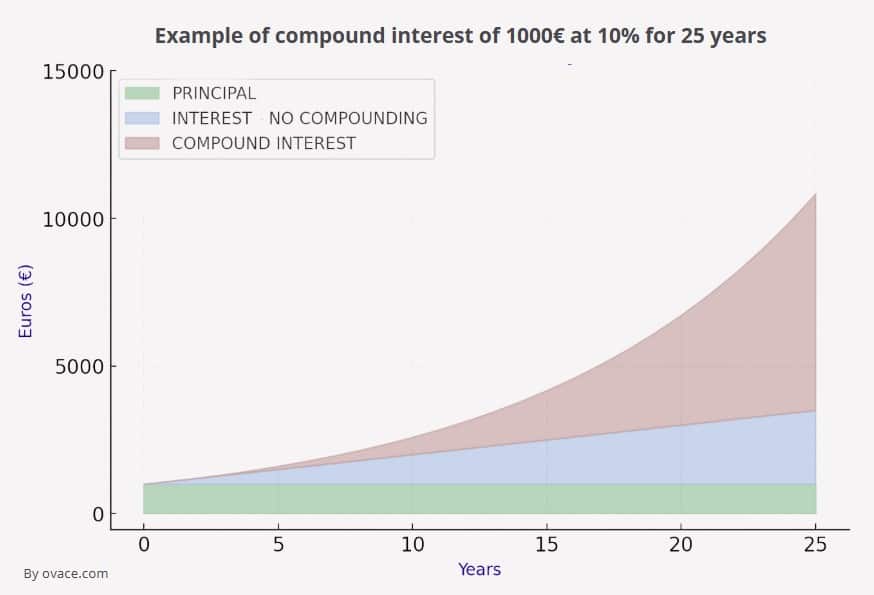

To better see the capitalization (adding the interest earned to the initial capital), we provide a graphic example. With an initial investment of 1,000 Euros, an investment term of 25 years at an annual interest rate of 10% (to simplify).

If we compare the compound interest line with the standard interest line and the non-interest line, we can see how compounding increases the value of the investment.

? Any questions about the estimate compound interest you can contact us from the contact section in the footer.

Frequently asked questions about calculating compound interest

What is compound interest?

It is when the interest you earn is added to the initial capital and then generates more interest in subsequent periods, making your money grow faster over time.

How does compound interest differ from simple interest?

In simple interest, you only earn interest on the initial amount. In compound interest, you earn interest on the initial amount plus the accumulated interest.

What is the formula for compound interest?

The formula is: A = P (1 + r/n)^(nt), where A is the final amount, P is the principal (initial capital), r is the annual interest rate (in decimal), n is the number of times it is compounded per year, and t is the time in years.

What if the time is not a whole number of years?

Use the exact time in years as a decimal. For example, 18 months = 1.5 years, and adjust t in the formula.

What do I need to start calculating compound interest?

You need to know the initial amount (P), the interest rate (r), the compounding frequency (n), and the time (t).

What is capitalization?

Capitalization is the frequency with which interest is added to the initial capital. The more frequent the capitalization, the greater the growth generated by compound interest.

What does it mean for interest to be compounded monthly?

It means that interest is calculated and added to the capital 12 times a year (once per month), using n = 12 in the formula.

How can I calculate how much I will have with compound interest?

Use the formula or an online calculator. For example, if you invest $1000 at 5% annual compounded annually for 10 years: A = 1000 (1 + 0.05/1)^(1*10) = $1628.89.

What do I do if the interest rate is in percentage?

Convert it to decimal by dividing by 100. For example, 5% is 0.05.

What factors affect compound interest?

The factors that affect compound interest are the initial capital, the interest rate, the investment time, and the compounding frequency.

Why is compound interest said to be so powerful?

Because the growth is exponential: the longer you leave the money, the faster it grows, thanks to interest on interest.

What if I invest a small amount with compound interest?

Even if it’s small, with time and a good rate, it can grow significantly. For example, $100 at 6% compounded annually for 30 years becomes $574.35.

Does compound interest work the same in debts?

Yes, in things like loans or credit cards, compound interest can make the debt grow quickly if you don’t pay it.

How long do I need for my money to double with compound interest?

Use the “rule of 72”: divide 72 by the annual interest rate (in percentage). For example, at 6%, your money doubles in 72 / 6 = 12 years.

How can I take advantage of compound interest in real life?

Invest early in things like savings accounts, funds, or stocks that offer compound interest, and let time do the work.

In what types of investments is compound interest applied?

Compound interest is applied in a variety of investments, from savings accounts, certificates of deposit (CDs), investment funds, and retirement plans.